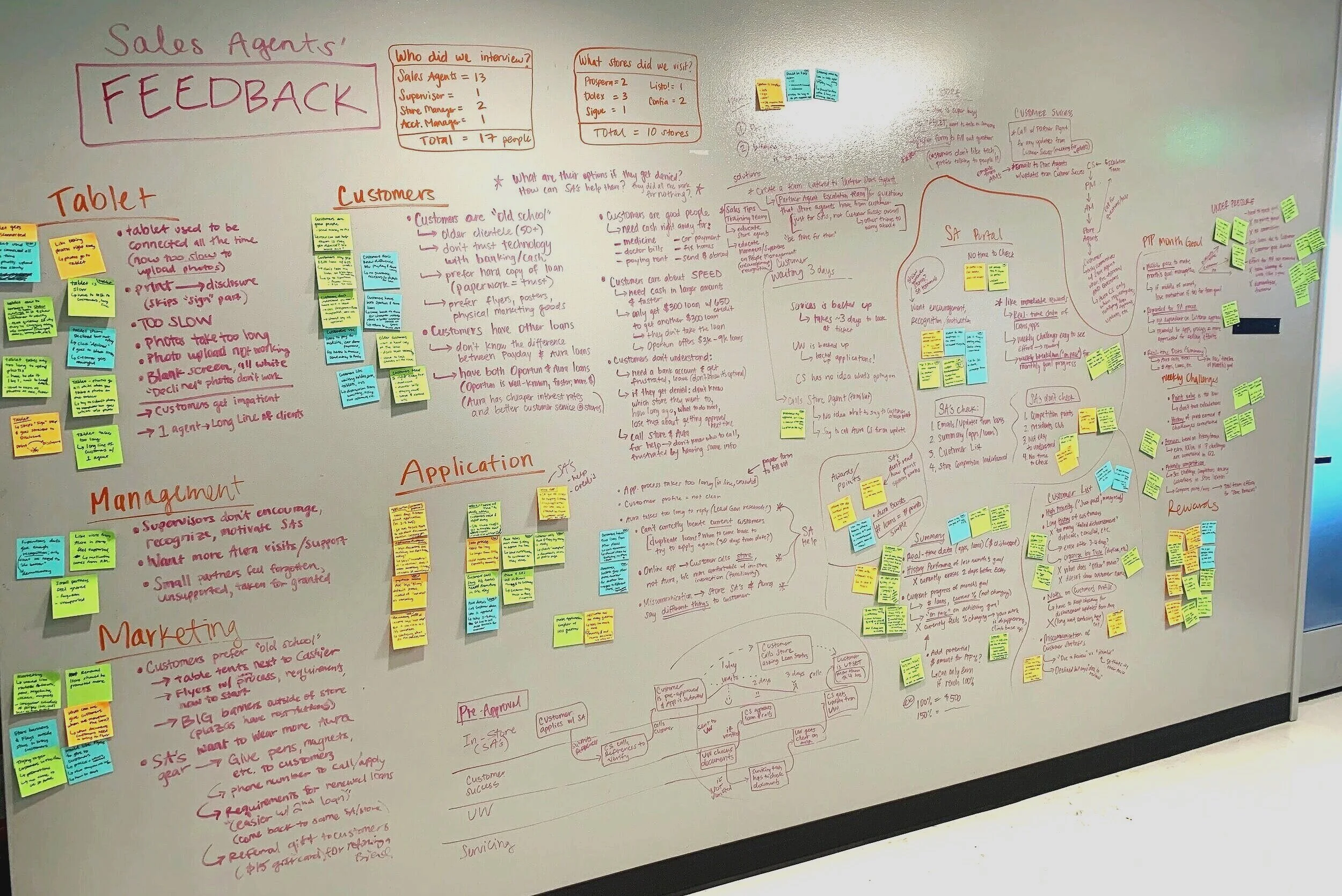

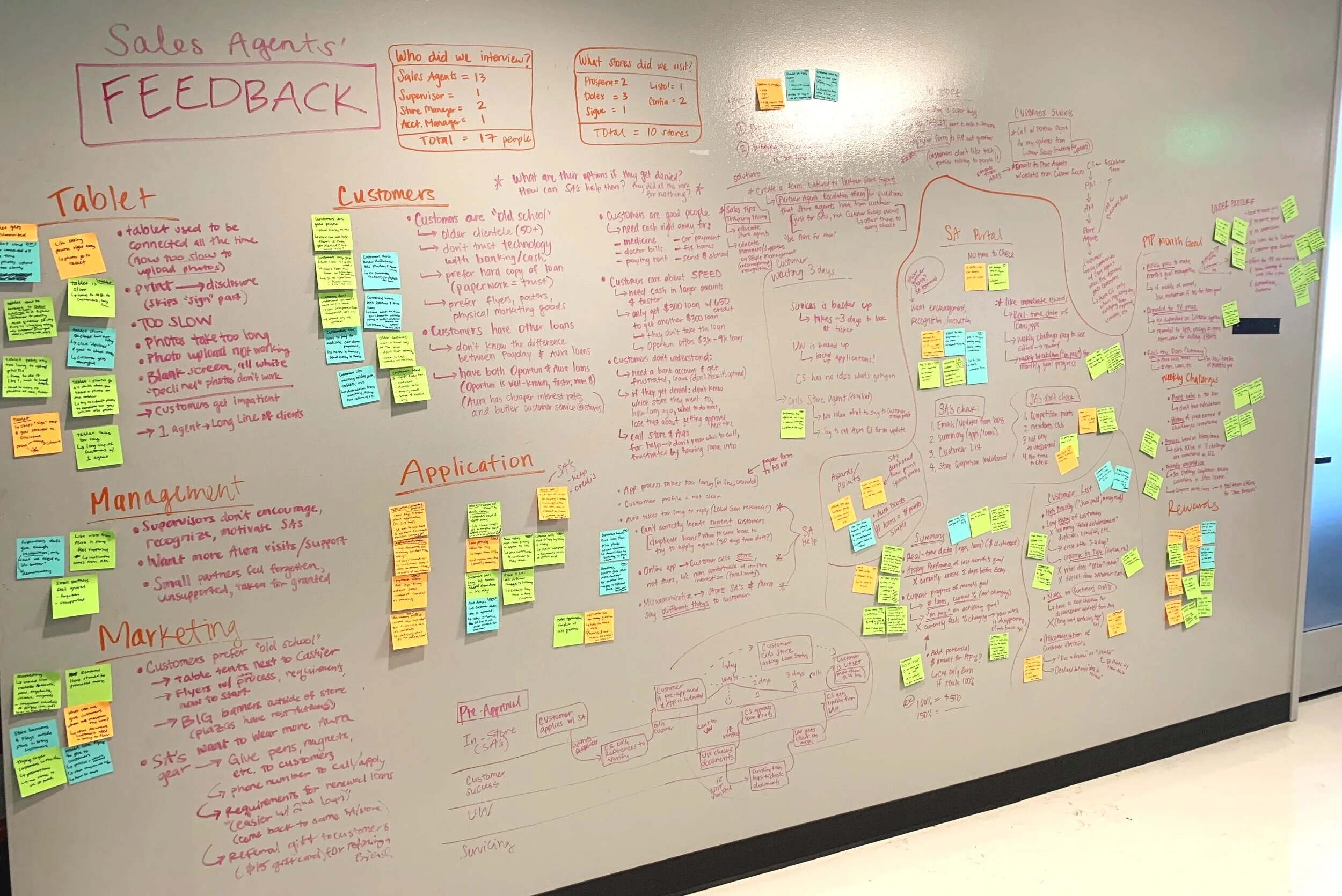

Photo of user research insights and analysis after compiling Sales Associates’ interviews and feedback.

what motivates a person’s productivity?

discovering what matters to aura’s sales associates

Aura was a financial technology start-up based in San Francisco, CA that provided an alternative to payday loans by giving access to credit-building personal loans within under-served and under-banked communities. Since Aura was a white-label financial service, we partnered with various financial centers (e.g. Dolex, Prospera, Sigue, etc.) that were already established and trusted in these communities.

Our team had insight on who Aura’s customers were, but we didn’t know much about our sales associates and what matters to them when performing their work. With multiple interviews, store visits, and talking to their supervisors, our qualitative research efforts discovered our sales associates’ needs, desires, and any bottlenecks that diminished their productivity.

Thanks to listening to our users, Aura was able to implement a new commission program into our product design that improved our sales associates’ productivity by 15%!

Team & Duration

On this project I worked as a Lead UX Researcher, focusing on qualitative research involving 24 sales associates, 2 supervisors, 2 store managers and 1 territory manager, all of whom were mostly Spanish speakers. I worked closely with my teammates, Senior Product Designers Brittany Pepper and Tara Chandi, along with other colleagues from different departments, respectively.

As this was an ongoing research endeavor, this project lasted four months total.

Tools & Methods

User Interviews

Contextual Inquiry // Field Research

Usability Testing

Affinity Mapping

User Flows

Service + Interaction Design

the opportunity

How might we help our sales associates perform better in their work environment?

Our team did not know why most of our sales associates’ performance numbers were stagnating, while others’ numbers were skyrocketing. How can we help others achieve the same success? Since we weren’t well-versed in the day-to-day duties of our partners, contextual inquiry was necessary to understand how we can design better products that fit their work environment and help sales associates better serve our customers.

solution

Design a new incentive program to better address the priorities of sales associates

Thanks to extensive user research and analysis, our sales associates were very honest and direct about the issues they were having. The main issues that came up were: (1) not being compensated fairly for the effort, (2) data was hard to understand and keep track of their progress, and (3) miscommunication issues between Aura and customers due to lack of adequate marketing and support resources.

After trial and error, our team came up with three solutions to address these issues:

Created a better compensation program called “Pay for PA” - sales associates were now compensated on their efforts to guide customer through the pre-approval loan process instead of only after the customer had been approved and took out the loan (an endeavor that was out of the sales associates’ control)

Improved real-time data on sales progress and goals achievement - sales associates could now understand their performance data and whether they were on track to meet their sales goals for the month

Increased brand awareness and support resources - sales associates were given a resource packet to address any questions customers had, as well as an FAQ section, contact information for Aura support, and sales tips throughout the loan application with proper screenshots and explainers.

step one: familiarization

How effective is our current system for sales associates?

My first step was to understand how the current “Aura + Partner Stores” ecosystem worked (or didn’t work). No one had really interviewed the sales associates themselves, so we visited 19 stores across 9 of our partners in the Los Angeles and Houston areas to do field research and interviews.

In total, I interviewed 24 sales associates, 2 store managers, 2 supervisors, and 1 territory manager.

How do sales associates feel about Aura loans?

Our sales associates are the first impression that our borrowers see, so it’s important that they actually like our product! I did some contextual inquiry by interviewing sales associates in their work environment, and to observe how they pitch the Aura loan and describe it to customers. They were eager to provide feedback and suggestions on how to improve the product systems in place.

A customer talking to a sales associate at Dolex, one of Aura’s partners.

Here is some of the feedback that our sales associates provided:

Lack of fair compensation for the effort needed to help a customer apply for a loan

Data was confusing and hard to understand their sales performance and progress towards goals

Lack of brand awareness and miscommunication between customers and Aura when addressing problems

Need more support and resources when first training, such as selling tips, how-tos, etc.

Rewards system was confusing to learn, didn’t understand how to earn more rewards or enter competitions

This feedback about our product led me to wonder…

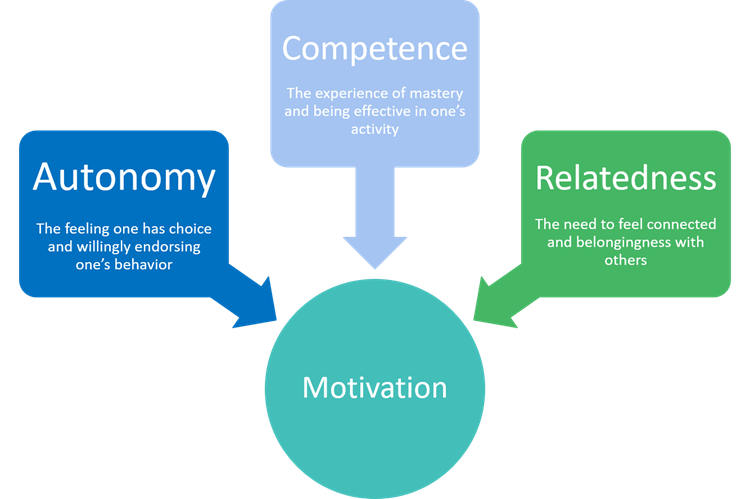

What is the key to a person’s motivation?

So after collecting so much feedback from our sales associates, I wondered: what’s missing in their environment that can help their innate motivation to perform better? This is where self-determination theory comes in handy!

According to verywellmind.com, self-determination theory is when “people are able to become self-determined when their needs for competence, connection, and autonomy are fulfilled.”

Infographic describing self-determination theory (courtesy of University of Rochester)

These three innate and universal psychological needs (autonomy, competence, and relatedness) are what motivates humans to grow and change, through the feelings of agency over their work, competence in achieving their goals, and being supported by their managers and team members. By using self-determination theory as our framework, we could address these pain points of our design to increase sales associate productivity.

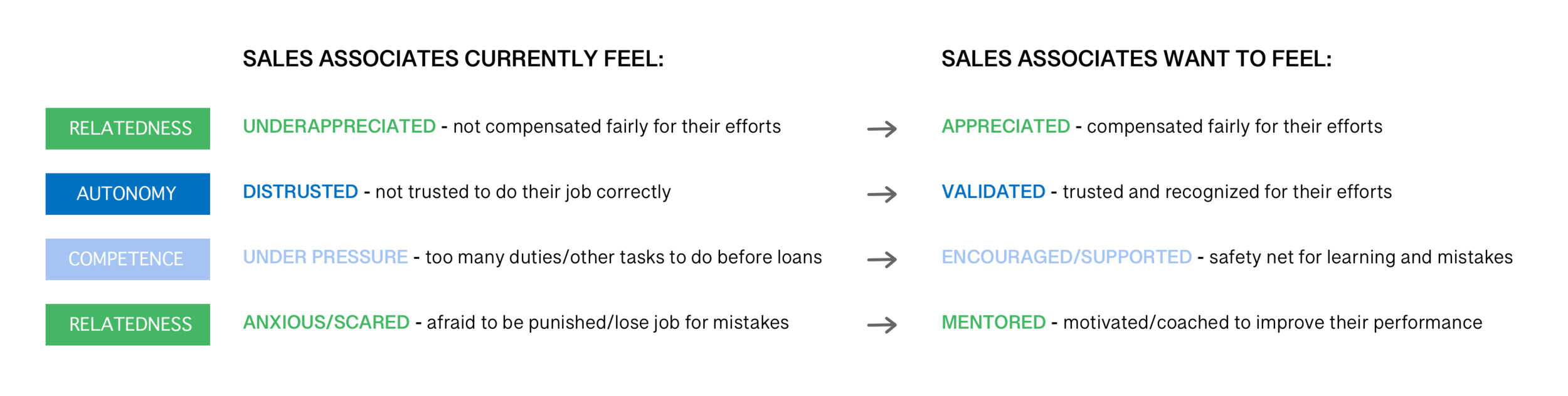

After multiple interviews, I noticed a trend of sales associates’ needs being unmet, correlating to the self-determination theory of motivation:

Based on interviews from 24 sales associates across Los Angeles and Houston areas.

step two: insights & analysis

After collecting and analyzing 24 interviews, patterns started to emerge from our collected feedback. I used affinity mapping of key phrases and separated them by topic and/or department. This allowed me to distribute research findings in an organized way so that each team could focus on improvements that corresponded to their work.

Affinity map of sales associates’ feedback categorized by topic.

There were a lot of service design issues that hindered effective productivity throughout their work day. By examining our designs out in the world, we got to see how our sales associates actually used, or didn’t use, the tools we gave them due to circumstances in their work environment that were out of their control.

Screenshot of sales associate portal used to see goals, progress, and rewards.

ISSUE #1: SALES ASSOCIATE PORTAL WEBSITE

One of the biggest complaints was the sales associate portal website. Although its purpose was to be a site for our sales associates to check their goals and progress, their busy work environment did not allow them to spend time checking anything in depth. Sales associates often had long lines of customers to help throughout the day, along with other work duties besides selling Aura loans. There was no downtime available for them to peruse the website to check their progress, let alone decipher the confusing data presented (which was also not real-time data, therefore could be inaccurate at times). These obstacles affected the sales associates’ trust in Aura’s product, and thus their productivity!

Photo of a sales associate helping a long line of customers at Dolex, a partner store.

ISSUE #2: UNFAIR COMPENSATION MODEL

Sales associates juggle many duties, mainly money transfers and other quick transactional items. In comparison, pitching an Aura credit-building loan to each customer takes a relationship built on trust with the sales associate, knowledge on the product, and most of all, time!

Convincing a customer to apply for the loan took at least 5 to 15 minutes compared to quick transactions that most customers make, an average of 3 minutes. With a long line of impatient customers, you can imagine the stress and pressure that a sales associate would feel pitching the loan!

Sales associates repeatedly mentioned how they felt it was unfair to lose their commission pay if the customer was for whatever reason rejected or did not decide to take out the loan. All the time and effort made to get the customer to apply was not rewarded in the existing model, where commission was only provided when a customer actually took out the loan (something outside of the sales associates’ control).

View of a customer’s loan application, highlighting poor UX that caused performance anxiety for sales associates.

ISSUE #3: LACK OF SUPPORT + RESOURCES

For a lot of sales associates, this product is their first sales job. Unfortunately, not every store had supportive and mentoring managers to help these sales associates improve their selling skills. Contrary to their quick transactional duties, salesmanship takes practice and training, as well as thorough knowledge on the product they’re selling to instill confidence in the customer. Without proper training and support, most inexperienced sales associates felt anxious and overwhelmed with the thought of doing a poor job and not meeting their goals. This led to sales associates feeling too fearful to pitch the loan and skip it altogether.

A common theme I heard was the lack of visits from our Territory Managers. Sales associates really valued in-person interaction, especially check-ins from their Territory Manager so that they could ask any questions they had about the product or their progress towards monthly goals. We did not have enough Territory managers available to check-in as often as they needed, so we had to come up with creative solutions to help sales associates feel supported.

step three: PROPOSED SOLUTIONS

Our team came up with design improvements that addressed these issues to better support our sales associates. Since we knew now that a separate website portal was not helpful to sales associates, we added a progress bar with all the necessary information right above their application window. This eliminated the need for a separate window and forcing sales associates to click away from the customer’s application to see their current progress and goals.

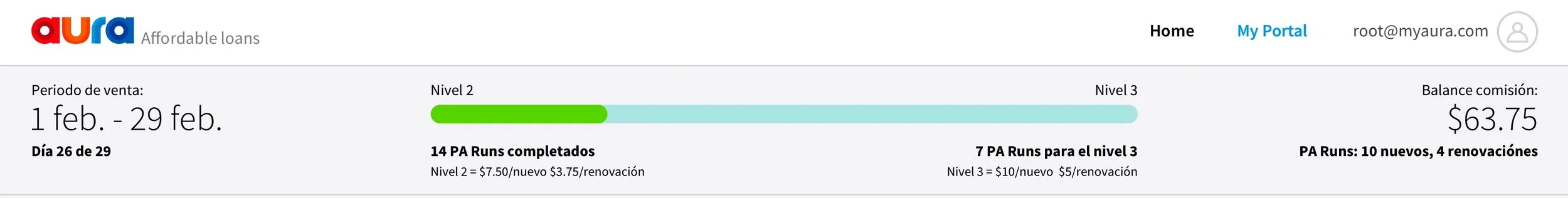

Screenshot of new design for sales associates to check their progress, monthly goals, and commission earned.

By keeping this bar at the top of their desktop window, sales associates knew exactly what their goals were, how much commission they’ve made, and could visually see how far along their progress was to get to the next commission level.

Our commission model was adjusted as well, now rewarding sales associates by how many pre-approval applications, or “PA Runs”, they completed. Each PA Run paid a certain amount per application depending on what level the sales associate was currently in. The more PA Runs completed, the higher amount of commission they earned per PA Run as they progressed to the next level.

As for better supporting our sales associates, we designed a resource packet with step-by-step instructions on how to go through the application, provided tips on sales techniques, and how-to guides for accessing their rewards and commissions. We also created a new help hotline with our Customer Success team so that sales associates can call Aura directly whenever they needed help or had questions that could not be answered within the resource packet.

RESULTS: INCREASED PRODUCTIVITY BY +15% WITHIN ONE MONTH

Thanks to user research and listening to the feedback of our sales associates, we were able to increase trust and improved sales associate productivity by over 15% within one month! The biggest improvement that we saw was due to fundamentally altering our commission model from number of loan acquisitions to number of pre-approval applications. This gave our sales associates the agency they needed to feel in control of their commission results, thus enhancing their job performance.

Listening to our sales associates and advocating for their needs led to more trust in our brand. When sales associates trusted our product more, it translated to valuing and selling our product more authentically to customers, which helped Aura’s business goals overall.

Retrospective & next steps

Considering that no research on our sales associates had been done before, this was quite a successful project! Unfortunately Aura no longer exists due to the pandemic, but if we were able to continue I would have liked to create an ongoing research schedule. This was only the beginning to creating a great work culture with our sales associates out in the field.

Our next steps were to create an app that allowed sales associates communicate with their supervisors and our internal teams, including chat messaging, leaderboards, challenges, etc. I would also have liked to bring colleagues from different departments with me on field research trips so that our teams can get a closer look at who our users are and build empathy with them. With more exposure to the real world, our products could only get better in context.