Survey responses from Aura’s online customers to the question “What would you like to use your loan for?”

WHAT MATTERS IN A LOAN COMPANY?

UNDERSTANDING THE NEEDS OF AURA’S ONLINE CUSTOMERS

Aura was a financial technology start-up based in San Francisco, CA that provided an alternative to payday loans by giving access to credit-building personal loans within under-served and under-banked communities. Since Aura was a white-label financial service, we partnered with various financial centers (e.g. Dolex, Prospera, Sigue, etc.) that were already established and trusted in these communities.

After doing extensive research on our retail-facing customers (see retail customer personas here), we did not know how similar or different our online customers were. Since our retail customers were more comfortable with in-person assistance, what did our online customers value instead? Did they have similar financial needs? How similar are their values or lifestyles? These questions and more are what we wanted to answer in order to connect to a wider audience online.

Team & Duration

As the Lead UX Researcher on this project, I worked closely with my colleagues Senior Product Designers Brittany Pepper and Tara Chandi, Marketing Manager Vivian Tran, Researcher Consultant Dani Bicknell, and collaborated with our Customer Success team.

This research initiative was ongoing before the pandemic hit, and we worked on this for almost three months at the time.

Tools & Methods

Surveys

Usability Testing

Competitive Analysis

Personas

Content Strategy

Data + Insights Analysis

the opportunity

Who are our online customers? How might we better serve their financial needs?

We knew our retail customers pretty well, but wondered how online customers differed. Compared to our retail customers, our online customers reached a wider audience, and Aura wanted to make sure we were serving their needs above all other competitors. What are their financial goals? How can we resonate with their needs and values? Why did they choose an Aura loan over other options? Answers to these questions and more would help establish an online customer persona that multiple departments could use for their business decisions.

solution

Create an online customer persona to help inform business decisions and increase conversion rates

Our business objectives were to: (1) discover any pain points with the application process and/or loan product, (2) understand the financial goals of our online customers to better serve their needs, and (3) plan for any additional features or products that could help retain existing customers and expand to a wider audience. After the culmination of our online research, I created an online customer persona that could be used as a resource across departments to help make informed business decisions.

step one: familiarization

Who were our online customers? How were they similar or different from our retail customers?

We wanted to reach a vast amount of online customers, so we used surveys through SMS text links and collaborated with the Customer Success department for phone surveys. We created an online research call guide for Customer Success colleagues to use when calling online customers. By using these resources we were able to reach a lot of customers in a short amount of time:

88 survey responses through SMS text links to existing online customers

48 phone survey participants of existing online customers (thanks to Customer Success team)

Thanks to our Customer Success team’s efforts, we were able to compare demographics between retail and online customers:

Age of customers were fairly the same as retail, with the largest age group being 25 to 35 years old (44%) followed by 46 to 55 years old (25%) and 36 to 45 years old (19%).

Education seemed higher than our retail customers, with 64% having attended college, followed by 33% completing up to high school, and 3% attended graduate school.

Relationship status was also similar, with 47% being married, 32% being single, 15% in a relationship, and 6% being engaged.

We also learned about which competitors our respondents they were considering and what influenced their decision to choose Aura:

Photo of Sigue, one of Aura’s partner stores, next to Apoyo Financiero, a competitor.

Competitors included Oportun (our direct competitor), Camino Financial, Apoyo Financiero, etc.

Negative experiences from competitors included having higher interest rates, asking for co-signers, asking for more documents, and taking too long to complete the loan process.

Positive experiences including referrals from friends and flexibility with payments

step two: insights + analysis

What are the financial goals of our online customers?

Now that we were understanding our online customers’ backgrounds, we wanted to see what they used Aura loans for and how we could help them in reaching their financial goals. But what were their financial goals?

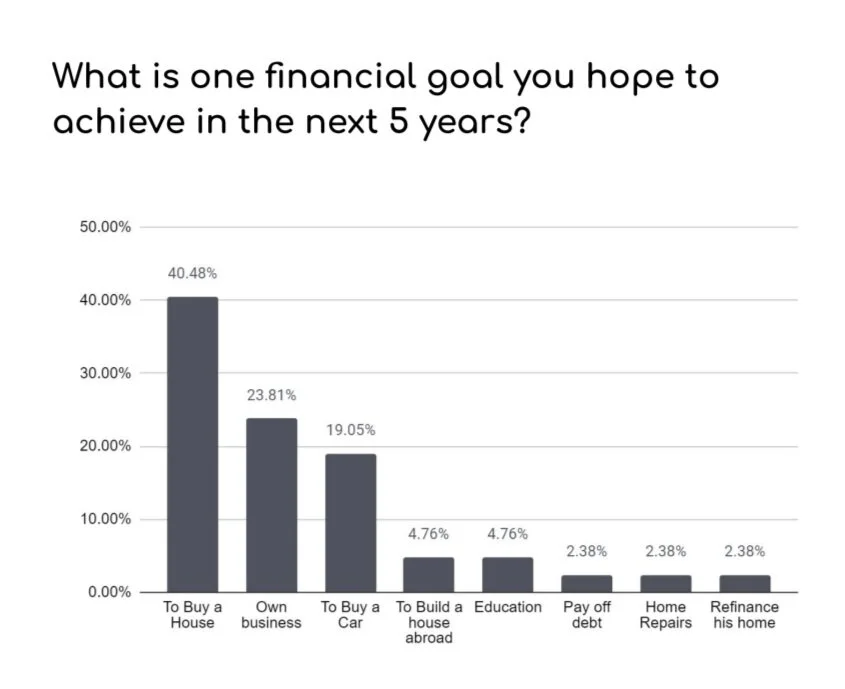

Survey results to the question “What is one financial goal you hope to achieve in the next five years?”

The top answers to the question “What is one financial goal you hope to achieve in the next 5 years?” were:

Buy a house (40%)

Own a business (24%)

Buy a car (19%)

Fund education (5%)

Pay off debt (2%)

Home repairs (2%)

Refinance a home (2%)

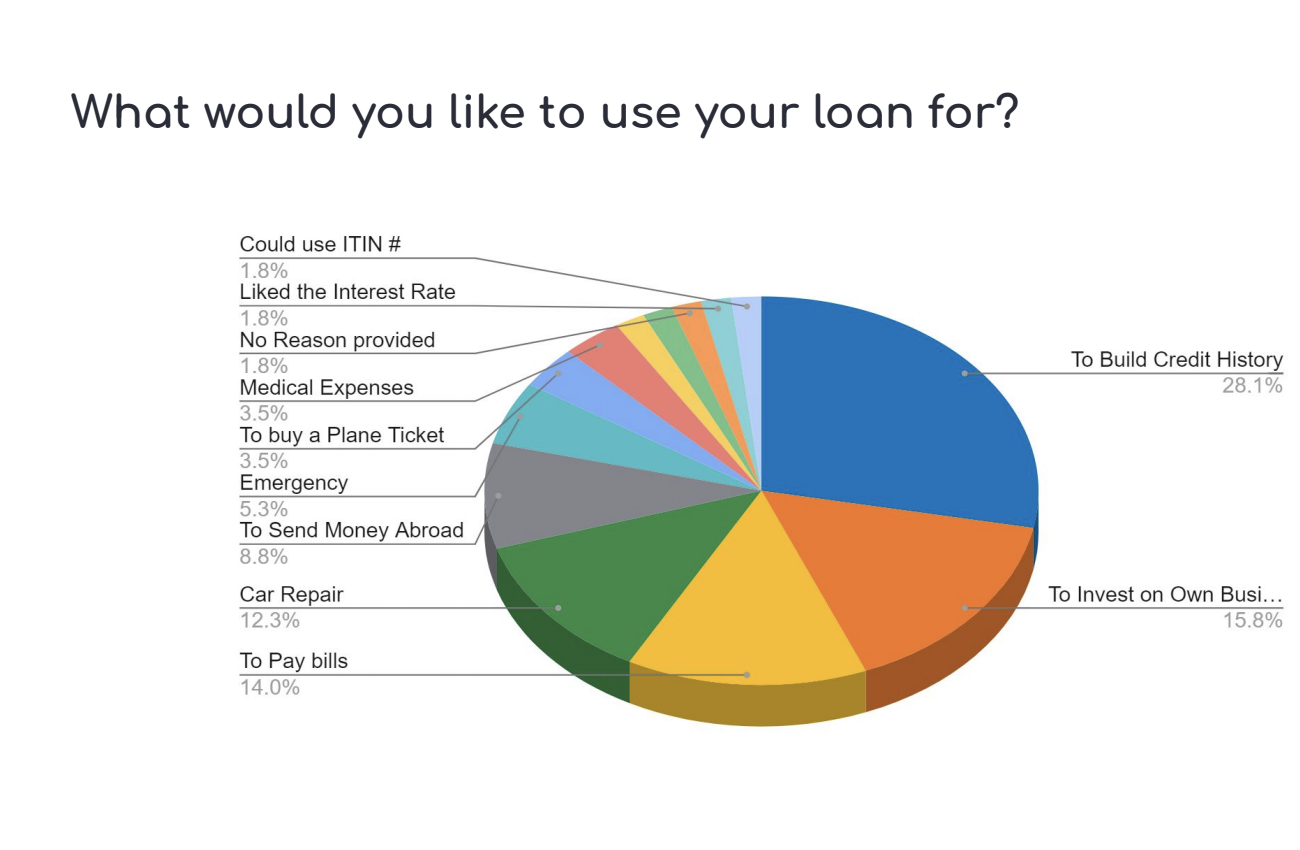

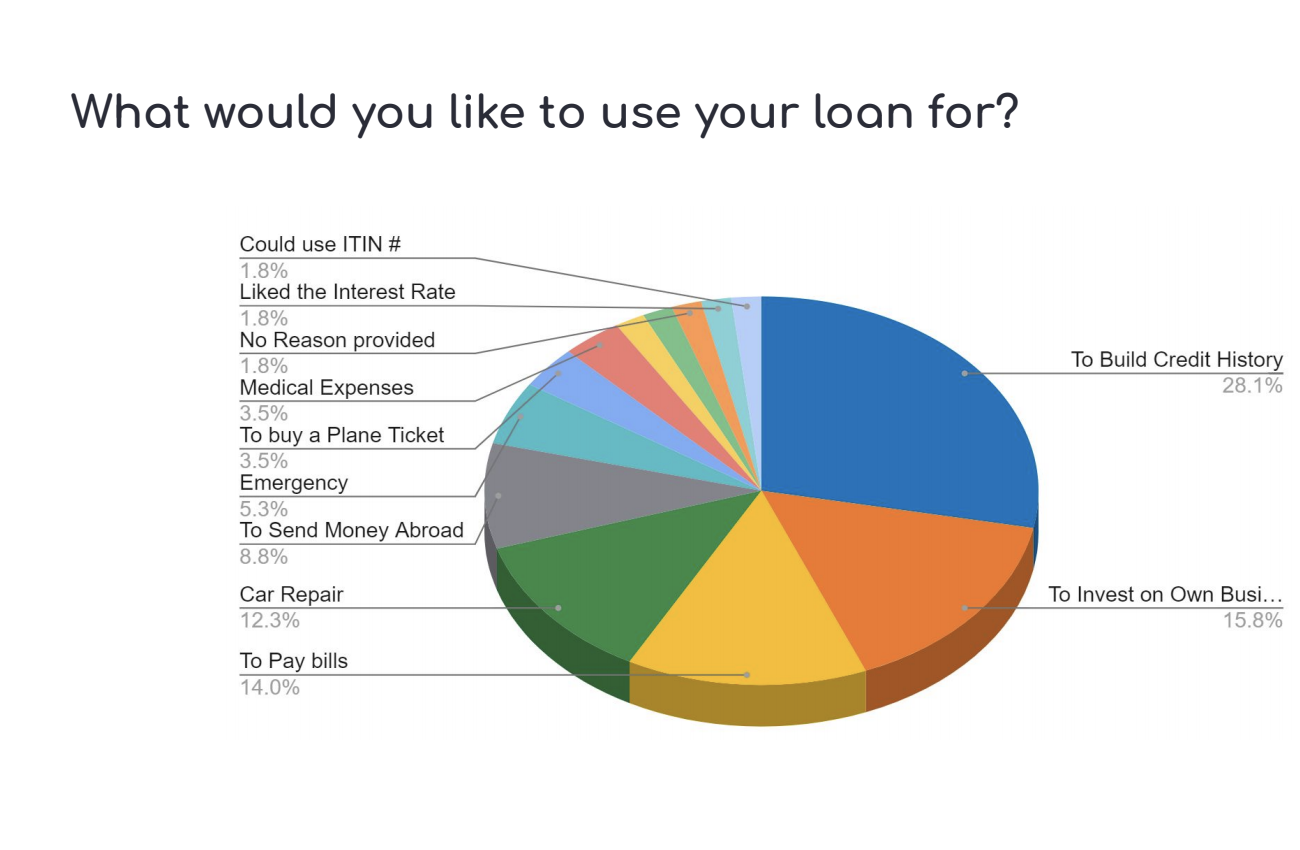

Survey results to the question “What would you like to use your loan for?”

With these results in mind, we can now see how our respondents’ financial goals relate to why they took out an Aura loan.

The top answers to the question “What would you like to use your loan for?” were:

Build credit score (28%)

Invest in own business (16%)

Pay bills (14%)

Car repairs (12%)

Send money abroad (9%)

All of these led to their biggest goal: building credit! Having good credit was a top concern for our respondents in order to get to the next step of their financial stability.

step three: usability testing

What difficulties did online customers have in applying for a loan?

Now that we knew a bit more about our online customers’ financial priorities, we wanted to know if there were any problems with our online application experience. According to surveys, over 60% of respondents said they had trouble applying for a loan due to the mobile document upload experience.

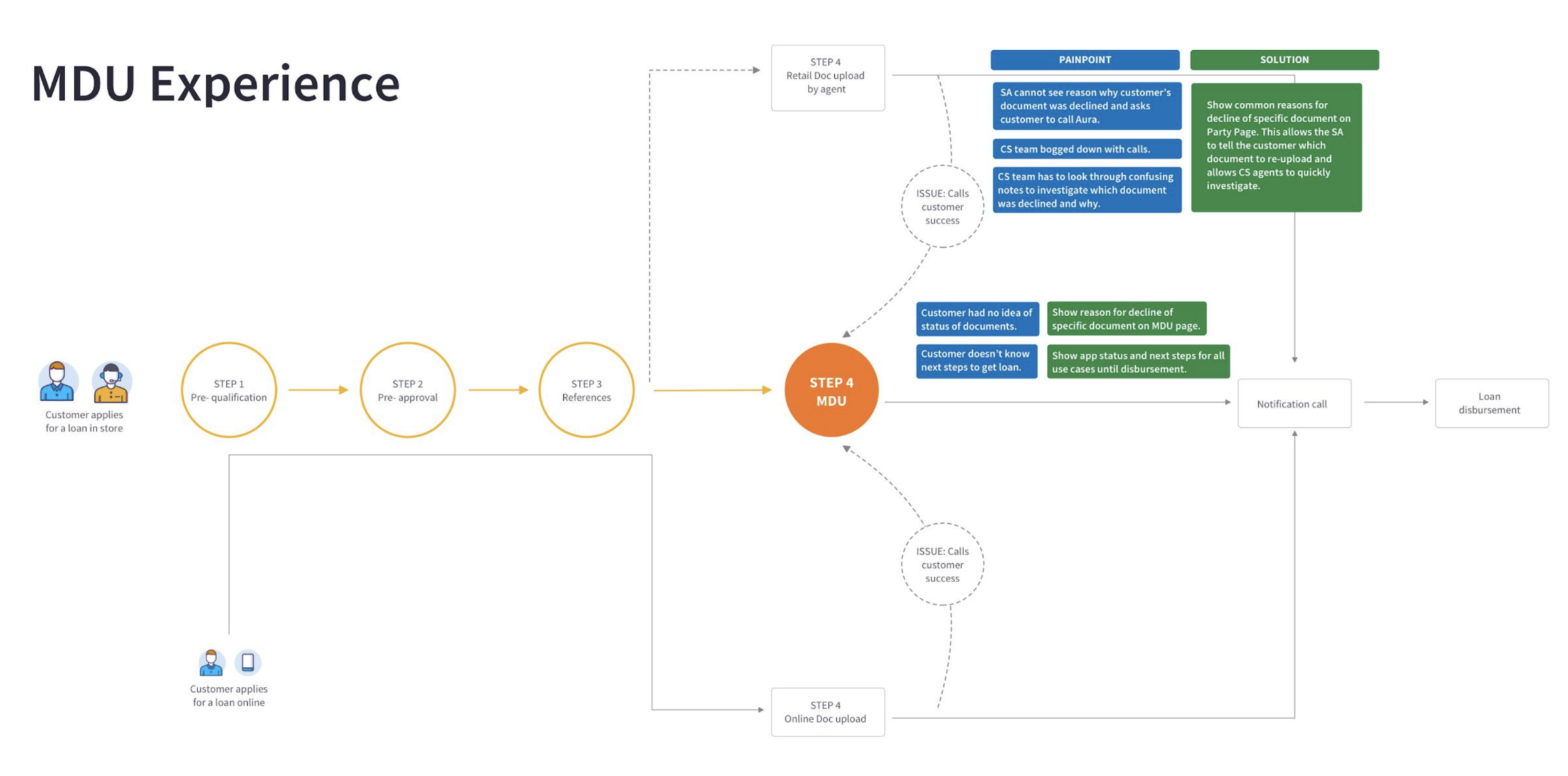

User journey map of a customer applying for an Aura loan, either through retail or online, highlighting the mobile document upload experience (courtesy of Tara Chandi).

Compared to the retail experience, where a sales associate uploads document photos for the customer, the online application required applicants to upload document photos themselves. To witness any mobile document upload pain points firsthand, I went to a partner store with two of my colleagues to conduct usability testing with six customers.

Photo of Lorena (left) conducting usability testing with a customer (right).

Common responses about the experience included:

Not being experienced with their smartphone

Asking a family member to help them

Stopped the application until a Customer Success agent called with assistance

Thinking the documents were sent, but Aura did not receive them

Worried about “doing it wrong” and messing up

Couldn’t edit their document photo uploads

Don’t know the status of their loan or what to do after

These comments were enlightening and allowed our product team to brainstorm solutions to improve the user experience, such as:

Improving the written copy to be more understandable

Show examples of what a good image looks like

Show the document status and reason for rejection, if necessary

Show their loan status after uploading documents

results

After learning about our customers’ pain points, discovering what matters to them, and uncovering any other gaps, our product team made adjustments to help improve conversion rates.

Some adjustments we made included:

More descriptive and specific copy in the documents section

Added UI elements such as corner markings in the camera so the customer knows where to center the document

Adding a completion page showing their progress and loan status after uploading documents

These minor adjustments improved conversion rates fairly quickly, with up to 20% of applicants finishing their loan application instead of dropping off at the documents section.

Also thanks to collaborative research efforts across departments, I was able to analyze the data and distill two personas for who our online customer is. These personas were very helpful for many departments when thinking about the customer, especially for our Marketing department who used these personas to make sure they were sending the right messaging to relate to potential customers online.

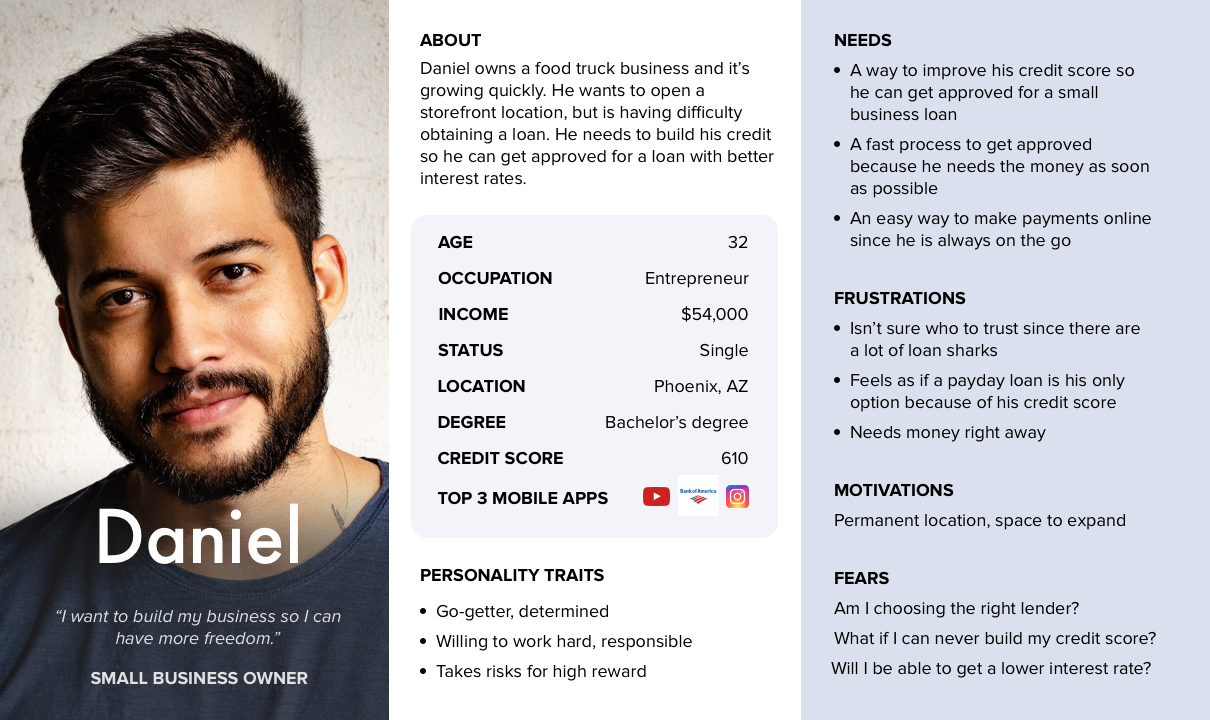

#1 Persona of an online customer “Daniel” describing their goals, needs, frustrations, and motivations.

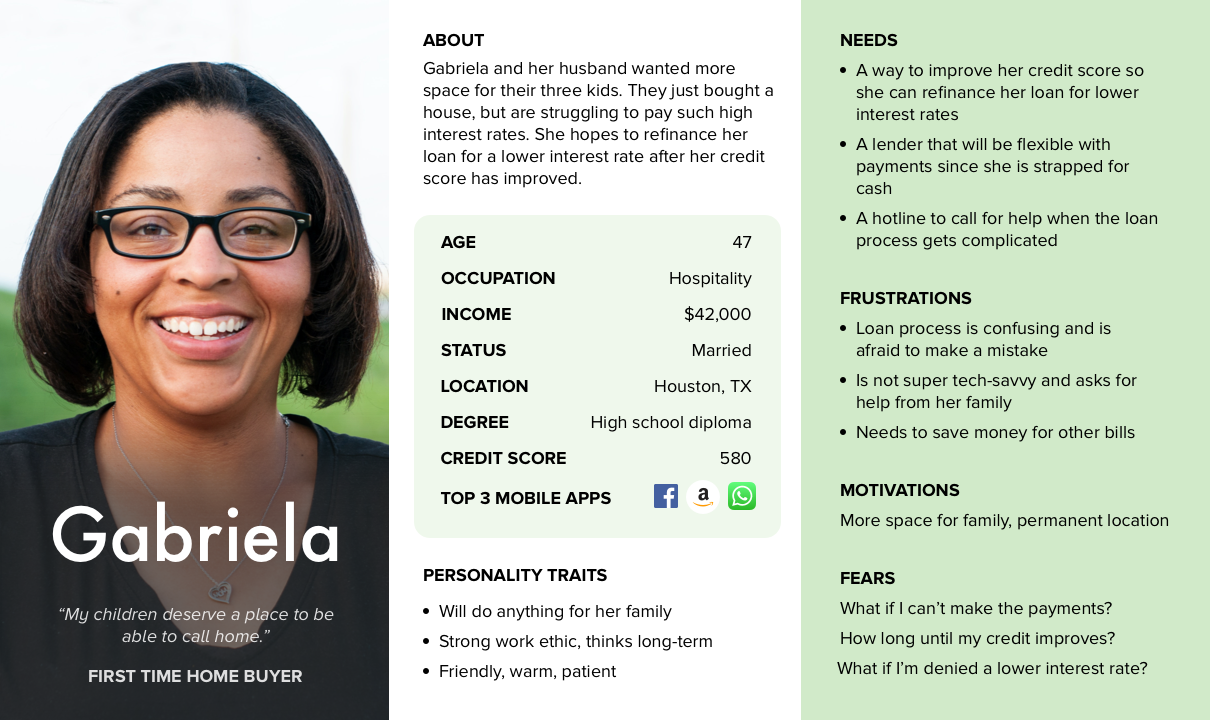

#2 Persona of an online customer “Gabriela” describing their goals, needs, frustrations, and motivations.

retrospective + next steps

Even though our online research was cut short due to the pandemic, I believe we had enough data to begin focusing on new products for our customers. Surveys do have their limitations, and if we had more resources I believe doing some virtual in-depth interviews with a cross-section of out online customers would bring even more insights on how to expand to broader audiences nationwide.

Feedback that we received from our respondents provided us with the following product ideas that would have been our next steps to follow:

Online Customer Portal - Customers repeatedly asked for a platform to view their payment progress (number of payments completed versus payments left)

Referral program - 98% of our respondents said they would be interested in a referral program that gave them X amount of money off their next payment

Contact info, Support, and FAQ - online customers wanted a quick and easy way to contact Aura for support in case they had questions or needed help

These suggestions and more would have been our next priorities, along with possibly a digital wallet for their loan to be dispersed in for easy mobile access.